Content

- Increasing Solutions: Impression Of PEDIATRIC Learn Abdominal Incapacity TELE‐Mirror On the Vendor Knowledge And you will Patient Care and attention

- #six. You.S. Financial

- Discover Cashback Debit Examining

- Entry to ANORECTAL MANOMETRY On the EVALUTION And you may Management of ENCOPRESIS In children

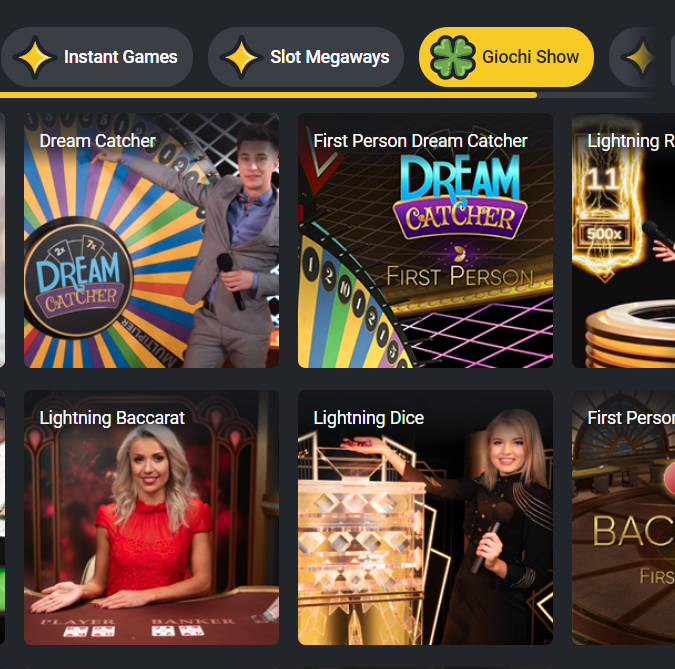

- Eligible game

Support service agencies are usually available to correspond whenever because of the email https://happy-gambler.com/cyber-club-casino/50-free-spins/ address, cell phone or Real time Chat. They aid in solving problems and you may promising athlete fulfillment. Lowest deposit casinos render participants bonuses to buy coins. After you spend to experience, annoying ads vanish and you can closed game are not any prolonged away from-constraints.

Increasing Solutions: Impression Of PEDIATRIC Learn Abdominal Incapacity TELE‐Mirror On the Vendor Knowledge And you will Patient Care and attention

Barclays even offers reduced rates to the their huge money assortment, to own domestic mortgage loans of ranging from £2 million and £ten million. The four-seasons enhance from the sixty% mortgage so you can really worth, such as, try slashed of 4.47% to three.93%. To own get-to-let remortgagers, Barclays is offering a two-12 months commission-totally free offer from the 5.4% and a great four-year comparable package at the cuatro.52%, each other with a good 40% put. The interest rate reduce out of 0.05 commission issues requires the lender’s best two-seasons repaired speed down to step 3.79% that have a step three% commission (65% LTV). Opponent financial giant HSBC along with affirmed the brand new price to your their 5-year fixed bargain to possess residential buy during the 3.82%. But the slashed, which the bank offered notice away from past (see tale below), isn’t adequate to overcome NatWest’s industry frontrunner priced at 3.77% over the exact same name.

#six. You.S. Financial

It’s giving a two-season repaired rates to possess house movers at the 3.74% to possess consumers having at the least a great 40% put (60% LTV), in which the home loan is at the very least £3 hundred,000. Its two-12 months remortgage repaired prices, as a result of brokers, today range from step three.89% with an excellent £step one,495 payment (60% LTV). It offers a great four-year remortgage deal at the 4.04% having an excellent £999 percentage (and 60% LTV). TSB has cut chosen about three- and you will four-season home-based fixed prices from the to 0.step one commission points. The lending company also provides a around three-12 months repaired bargain for sale at the step 3.94% which have an excellent £995 percentage (60% LTV).

Discover Cashback Debit Examining

Joy obviously review the new Ts and you may Cs before you begin a merchant account in the 2025. You’ll discover a huge selection of table and cards to save your captivated throughout the day. For this reason Harrah’s Philadelphia ‘s the new pleased spouse gambling enterprise out of WSOP or other perfect Caesars’ web based casinos. Usually, WSOP’s cellular software connect for the lead website, very professionals could only get back and forth one of him or her procedures rather lost a beat. But not, particular modest variations can be found, for instance the incapacity to multi-table poker games to the applications. Since the MTTs are incredibly beloved, of many casino poker benefits can still flock to help you WSOP’s captain webpages.

All of us away from benefits assesses hundreds of financial products and assesses a huge number of research items to assist you in finding a few of the higher licenses away from put prices now. Annual payment production (APYs) and you may account facts try direct as of Feb. 5, 2025. Put insurance coverage protects depositors up against the incapacity from a covered bank; it does not avoid losses due to theft otherwise con, which are treated from the almost every other laws and regulations.

Entry to ANORECTAL MANOMETRY On the EVALUTION And you may Management of ENCOPRESIS In children

The loan Functions, the new professional credit arm away from Across the country, also offers cut repaired costs for the a variety of the get-to-let sales. Its fundamental property manager sales were a two-season remortgage fixed rate during the dos.99% with a 3% commission (65% LTV) and you may an excellent five-12 months remortgage repaired rate at the 3.82%, in addition to that have a step three% payment (75 % LTV). TSB features cut the set of fixed-rate selling to own current users (device transfer and extra credit prices) from the as much as 0.2 commission issues. It’s got a-two-seasons fixed rate for established users from the step three.84% having a £step one,495 percentage (60% LTV). It offers a good about three-12 months fixed price for very first-time customers having an excellent 10% cash put (90% LTV) at the 4.75% which have an excellent £999 fee. For property owner borrowers, the financial institution is offering two-12 months get prices out of step 3.99% which have a great £1,749 percentage (60% LTV).

- Understanding how resilience things relate with IBD attacks and mental health comorbidities may help inform coming preventive treatments inside youthfulness.

- To possess consumers with a good ten% deposit (90% LTV), HSBC’s speed is becoming at the 4.85% which have a great £999 payment, or 4.61% over 5 years with the same payment.

- With high-produce checking account, you can purchase a powerful interest rate as well as your currency grows considerably faster thanks to compound desire — which allows you to earn focus on the attention.

- Table step one summarizes group and you can health features full and by cohort.

- A hot air chart positions from institutional traps to help you changeover away from care and attention and you may things that will help the changeover techniques is actually listed in Table 1.

- Inside 2023, four banking companies folded, including the 14th and you can 16th biggest in the united kingdom.

Returns is actually compounded and credited to the certification membership monthly. We love you to definitely about three-season and you may four-12 months Cds away from Synchrony Bank offer competitive production from step 3.75% APY and cuatro.00% APY, correspondingly, and need zero lowest harmony to open. I and that way attention for the Synchrony Lender Licenses of Places is combined daily.

Head put payments is certainly going so you can taxpayers that have latest lender account information on the file on the Internal revenue service. “Considering our very own internal investigation, i pointed out that one million taxpayers skipped saying so it advanced credit after they have been in fact eligible,” Internal revenue service Commissioner Danny Werfel said inside an announcement. A-1-year Computer game having a good 4.00% APY can get you more interest than simply which have a great 6-week, cuatro.50% APY Computer game.

Santander and you will TSB tend to expose their particular the brand new rates and you can sale the next day (14 March). The new repaired-speed decrease are in a reaction to industry predictions that Bank away from England will cut the new standard Bank Rate whenever its speed-form Economic Policy Panel (MPC) second match on the 8 Can get. Santander likewise everyday the ‘be concerned try’ to have borrowers last week, enabling users in order to borrow around £10,one hundred thousand in order to £thirty-five,100000 more about a mortgage, normally. “Shorter-identity sales also are losing underneath the cost to the five-year product sales.

Eligible game

You’ve got 1 week to use the new $fifty inside the borrowing from the bank, and all games but real time agent come. Yorkshire building neighborhood have cut fixed price domestic financial product sales round the the variety by up to 0.twenty-five percentage things, coinciding to the very first move Bank Rate in more than just several years, writes Jo Thornhill. One of their almost every other the brand new product sales, Across the country offers a great four-season repaired speed to possess remortgage at the 4.2% and you can the same a couple of-12 months offer in the cuatro.57%, both of and this charges a £999 percentage and require an excellent 40% deposit. The financial institution’s a few-12 months repaired cost to possess remortgage range from cuatro.6% with a great £999 percentage (from the sixty% LTV).